West Virginia Homestead Exemption Application . Expected to last for a continuous period of not less than twelve months. If you have any questions or need additional. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. In order to qualify for the homestead excess property tax credit (heptc), your property. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Twenty thousand dollar homestead exemption allowed. Below is a representative, nonexclusive list of property that may be exempt from property tax:

from w4-form-2018-printable.com

Twenty thousand dollar homestead exemption allowed. In order to qualify for the homestead excess property tax credit (heptc), your property. Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. If you have any questions or need additional. Expected to last for a continuous period of not less than twelve months. Below is a representative, nonexclusive list of property that may be exempt from property tax:

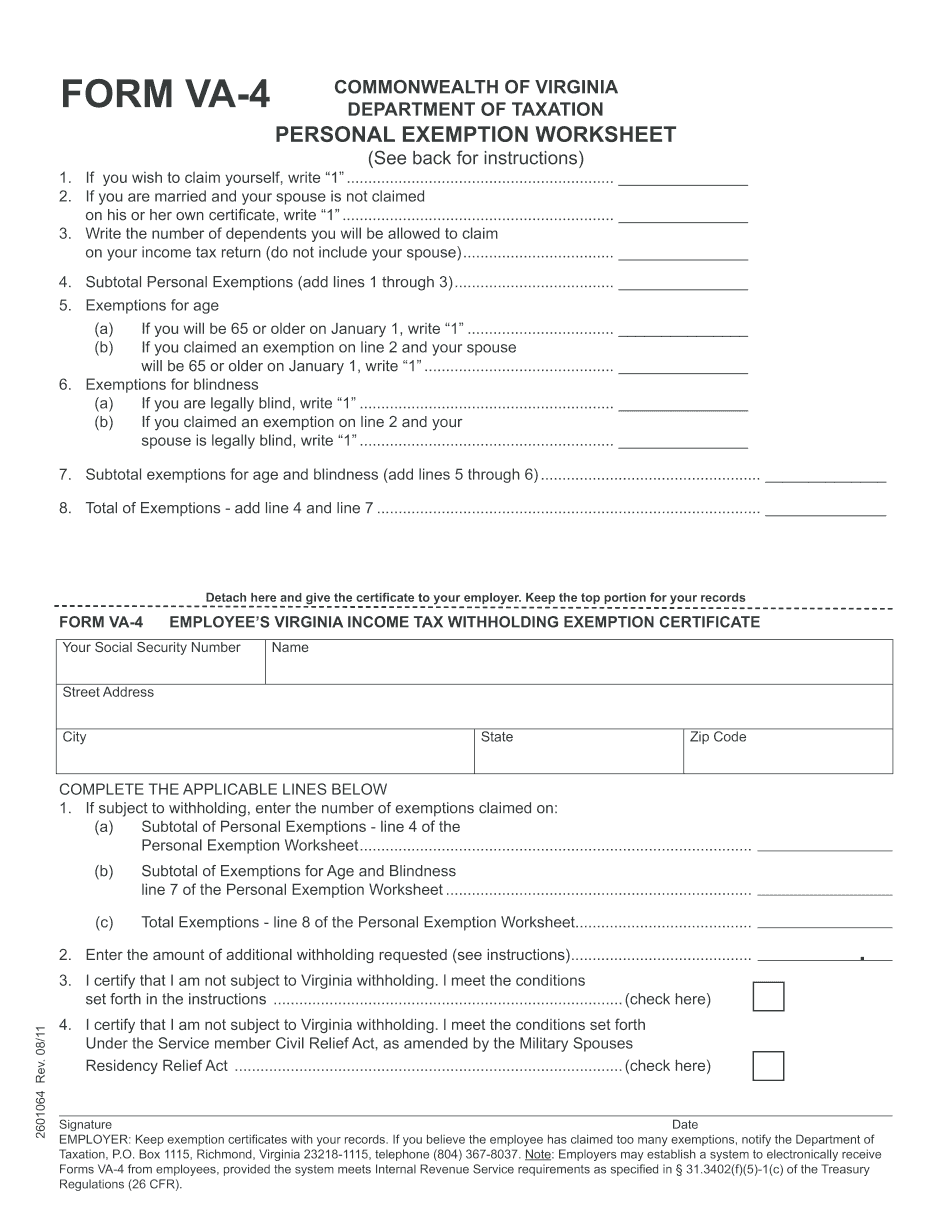

Virginia Form VA4 Printable (Employee's Withholding Exemption Certificate)

West Virginia Homestead Exemption Application Below is a representative, nonexclusive list of property that may be exempt from property tax: Expected to last for a continuous period of not less than twelve months. In order to qualify for the homestead excess property tax credit (heptc), your property. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Below is a representative, nonexclusive list of property that may be exempt from property tax: Twenty thousand dollar homestead exemption allowed. If you have any questions or need additional. Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person.

From discover.texasrealfood.com

West Virginia Homestead Exemption A Comprehensive Guide for Homeowners West Virginia Homestead Exemption Application In order to qualify for the homestead excess property tax credit (heptc), your property. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Below is a representative, nonexclusive list of property that may be exempt from property tax: If you have any questions or need additional.. West Virginia Homestead Exemption Application.

From www.withholdingform.com

West Virginia Employee's Withholding Exemption Certificate Form Wv It West Virginia Homestead Exemption Application To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Below is a representative, nonexclusive list of property that may be exempt from property tax: The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. In order. West Virginia Homestead Exemption Application.

From www.formsbank.com

Application For Residential Homestead Exemption Hood County Appraisal West Virginia Homestead Exemption Application The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. If you have any questions or need additional. Expected to last for a continuous period of not. West Virginia Homestead Exemption Application.

From discover.texasrealfood.com

West Virginia Homestead Exemption A Comprehensive Guide for Homeowners West Virginia Homestead Exemption Application Expected to last for a continuous period of not less than twelve months. Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person.. West Virginia Homestead Exemption Application.

From www.uslegalforms.com

TX Comptroller 50114 2019 Fill out Tax Template Online US Legal Forms West Virginia Homestead Exemption Application Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. The homestead disability exemption is a tax relief measure that provides for a. West Virginia Homestead Exemption Application.

From www.mortgagerater.com

Virginia Homestead Exemption Savings Explained West Virginia Homestead Exemption Application The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Expected to last for a continuous period of not less than twelve months. Below is a representative, nonexclusive list of property that may be exempt from property tax: Application for this exemption must be submitted to the. West Virginia Homestead Exemption Application.

From www.exemptform.com

West Virginia Tax Exemption Certificate Form West Virginia Homestead Exemption Application The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. In order to qualify for the homestead excess property tax credit (heptc), your property. Twenty thousand dollar. West Virginia Homestead Exemption Application.

From www.exemptform.com

Form Homestead Exemption Wa State West Virginia Homestead Exemption Application Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. Expected to last for a continuous period of not less than twelve months. In order to qualify for the homestead excess property tax credit (heptc), your property. Twenty thousand dollar homestead exemption allowed.. West Virginia Homestead Exemption Application.

From www.slideshare.net

Homestead exemption form West Virginia Homestead Exemption Application If you have any questions or need additional. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. Below is a representative, nonexclusive. West Virginia Homestead Exemption Application.

From va-homestead-deed-for-personal-property.com

Virginia Homestead Exemption Application Fill Online, Printable West Virginia Homestead Exemption Application Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. Twenty thousand dollar homestead exemption allowed. To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Expected to last for a continuous period. West Virginia Homestead Exemption Application.

From www.exemptform.com

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable West Virginia Homestead Exemption Application To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Twenty thousand dollar homestead exemption allowed. In order to qualify for the homestead excess property tax credit. West Virginia Homestead Exemption Application.

From discover.texasrealfood.com

West Virginia Homestead Exemption A Comprehensive Guide for Homeowners West Virginia Homestead Exemption Application Twenty thousand dollar homestead exemption allowed. Below is a representative, nonexclusive list of property that may be exempt from property tax: To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Expected to last for a continuous period of not less than twelve months. In order to qualify for the. West Virginia Homestead Exemption Application.

From www.formsbank.com

Harris County Homestead Exemption Form printable pdf download West Virginia Homestead Exemption Application Below is a representative, nonexclusive list of property that may be exempt from property tax: The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Expected to last for a continuous period of not less than twelve months. Twenty thousand dollar homestead exemption allowed. If you have. West Virginia Homestead Exemption Application.

From w4-form-2018-printable.com

Virginia Form VA4 Printable (Employee's Withholding Exemption Certificate) West Virginia Homestead Exemption Application If you have any questions or need additional. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. In order to qualify for the homestead excess property tax credit (heptc), your property. Expected to last for a continuous period of not less than twelve months. Twenty thousand. West Virginia Homestead Exemption Application.

From www.exemptform.com

Example Of Homestead Declaration Certify Letter West Virginia Homestead Exemption Application Below is a representative, nonexclusive list of property that may be exempt from property tax: The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. In order to qualify for the homestead excess property tax credit (heptc), your property. Expected to last for a continuous period of. West Virginia Homestead Exemption Application.

From discover.texasrealfood.com

West Virginia Homestead Exemption A Comprehensive Guide for Homeowners West Virginia Homestead Exemption Application The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Application for this exemption must be submitted to the assessor of the county in which the property is located by december 1st for the next calendar year. If you have any questions or need additional. To apply. West Virginia Homestead Exemption Application.

From homestead-declaration-form.pdffiller.com

Homestead Declaration Fill Online, Printable, Fillable, Blank pdfFiller West Virginia Homestead Exemption Application Expected to last for a continuous period of not less than twelve months. Below is a representative, nonexclusive list of property that may be exempt from property tax: If you have any questions or need additional. Twenty thousand dollar homestead exemption allowed. In order to qualify for the homestead excess property tax credit (heptc), your property. Application for this exemption. West Virginia Homestead Exemption Application.

From www.dochub.com

Homestead exemption Fill out & sign online DocHub West Virginia Homestead Exemption Application Expected to last for a continuous period of not less than twelve months. The homestead disability exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Below is a representative, nonexclusive list of property that may be exempt from property tax: To apply for homestead exemption, you must bring the. West Virginia Homestead Exemption Application.